Oxfam released a new report on India’s burgeoning economic inequality caused by the financial aggrandizement of a handful of big crony-comprador capitalists at a time when masses have been facing an unprecedented financial crisis. Oxfam’s inequality report stirred a hornet’s nest as it was released on January 17th 2022, a day before the Davos World Economic Forum (WEF) meet, attended by Prime Minister Narendra Modi.

The report, “Inequality Kills: India Supplement 2022”, showed that 98 rich Indians collectively own $657bn, which is equal to the wealth owned by India’s 552bn poorest people who are at the bottom of the economic pyramid. Oxfam’s inequality report also showed that while the number of India’s dollar billionaires—whose net worth is above $1bn—rose from 102 in 2020 to 142 in 2021, the share of the bottom 50% of the population in national wealth fell to 6%.

According to the Forbes Billionaires Report, quoted in Oxfam’s inequality report, the combined wealth of 100 richest Indians hit a record high of $775bn in October 2021. Around 80% of these rich Indian families experienced an increase in wealth in 2021 vis-à-vis 2020. Around 61% of these billionaires added $1bn or more to their collective wealth in 2021, while 84% of Indian households suffered due to a significant decline in their incomes.

Most importantly, Oxfam’s inequality report showed how Modi’s most-favoured capitalists like Gautam Adani and Mukesh Ambani’s wealth grew manifold at a time when millions of Indians continue to suffer due to rising unemployment and skyrocketing inflation, especially food price inflation. The data once again brought out the vile and unapologetic corporate appeasement policy of the Modi regime, which it even doesn’t bother to obfuscate anymore.

Crony capitalism’s growth according to Oxfam’s inequality report

According to Oxfam’s inequality report, which cited the data from Forbes, Adani earned one-fifth of the total wealth that the richest 100 Indians earned in 2021. In a year, Adani’s wealth increased eight times from $8.9bn in 2020 to $50.5bn in 2021.

The report credits Adani’s acquisition of 74% of stakes in Mumbai’s international airport, the Carmichael coal mines in Australia, etc, for the rapid rise in his wealth. However, apart from these two, there have been several allegations against Adani from circumventing tax regimes through shell companies to gaining mining rights in pristine forests using his influence on the BJP.

Except for a sudden shocker in mid-2021 caused by the allegation of sudden freezing of the trading accounts of a few of the conglomerate’s alleged shell companies, Adani’s wealth juggernaut continued unabated throughout the pandemic period.

Modi’s other big sponsor, Ambani, who is the richest Indian and owns India’s largest conglomerate Reliance Industry Ltd (RIL), experienced an increase of his wealth from $36.8bn in 2020 to $85.5bn in 2021. His growth can be attributed to the constant inflow of foreign capital into RIL’s new retail venture.

Pew Research’s study earlier revealed the increasing wealth gap

Before Oxfam’s inequality report, a study by Pew Research showed that during the pandemic-hit 2020, India’s middle-class or middle-income group—who earn between $10.01 to $20 per day—shrunk by 32m. This was 60% of the global retreat in the number of people in the middle-income group.

At the same time, the report showed that India’s total poor—those who earn $2 or less a day—increased by 75m in 2020, which is also 60% of the global increase in poverty.

What propelled this wealth gap in India?

Oxfam’s inequality report blamed the Modi regime’s corporate tax cut as the major reason behind the rising wealth inequality in India. Though it’s a fact that the Modi regime has cut down the corporate tax significantly, apparently to “promote investment”, it’s not the only reason behind this rising wealth inequality in India.

In this article and this one, it’s shown how the Indian crony-comprador capitalists have been using the fictitious capital route, thanks to the Modi regime’s patronage, to multiply their wealth. Moreover, big corporates have taken huge debts from the public sector banks (PSBs) and didn’t repay, resulting in rising bad debts of the public sector banks.

According to the Reserve Bank of India’s data, top PSBs have written off bad debts amounting to Rs 4.37 trillion between April 2018 and December 2020. Mostly such huge bad debt write-offs help the big corporates only. Now, as the money taken from these PSBs is invested in fictitious capital development and profiteering, therefore it’s also propelling the wealth of the big capitalist sharks of India.

The privatisation of public sector industries by the Modi regime has been propelling the wealth growth of big comprador capitalists. From the cash-rich Life Insurance Corporation of India (LIC), Steel Authority of India Ltd (SAIL), general insurance companies, Indian Railways to the PSBs, everything is on the privatisation platter of the Modi regime. Despite all opposition, Modi managed to sell Air India to Tatas at a throwaway price. Other public sector assets are in the pipeline of being liquidated as well.

Why the government is nonchalant about the poor?

When both poverty and unemployment are on the rise, a concerned non-Marxist government will take affirmative actions to increase employment opportunities and create demand in the market, following the Keynesian theory. However, the Modi regime didn’t traverse that route at all.

The reason behind the Modi government’s nonchalant attitude towards India’s poor, even denying them the right to food and health, is its policy focus on the 20% of the population that has purchasing power and is the consumer base for the corporates.

All policies, programmes and campaigns of the Modi regime target this segment, which consists of the urban elites and middle-class income groups belonging to the upper-caste Hindu strata. Oxfam’s inequality report shows how the incessant cuts in social sector spending by the Modi regime made the private healthcare and education sector experience a boom, thanks to the purchasing power of these 20% Indians.

After India’s independence, the government focused on the upliftment of agriculture only to prepare the condition for industrial development. Realising the backward, semi-feudal economy as the principal obstacle to industrial development, the early post-colonial governments, especially under Modi’s bete noire Jawaharlal Nehru, identified two major obstructions on the path, wage-commodity obstruction and limited demand obstruction.

In his book, “Land Reforms In West Bengal & India’s Agrarian Economy”, Chittaranjan Das showed that the Congress party’s government under Indira Gandhi, through the much-hyped “Green Revolution”, overcame the wage-commodity obstruction through a continuous supply of food grains to the industrial workers at a stable price in the whole through the regulated and partial rationing system in the urban areas.

While the increase in crop production allowed, for a limited period, a scope for middle and big farmers to earn some surplus income from farming. This money helped in the expansion of the rural markets of industrial products.

Though the model solved the food crisis for a while, the immense class contradictions in rural India among the poor and marginal farmers and the rich farmers and feudal landlords didn’t allow the benefits to reach the bottom of the pyramid. This helped the feudal landlords and rich farmers from upper-caste Hindu strata to retain their hegemony amid severe rural wealth disparity.

With the advent of the neoliberal economy, especially since the 2000s, the successive Indian governments, especially Modi-led Hindutva fascism-incensed Bharatiya Janata Party’s (BJP) regime, have been continuously launching offensives against the poor and the downtrodden.

From the infamous land acquisition law that the Modi regime wanted to enact in 2015 to the proposed disenfranchisement of India’s poor people, irrespective of religion, under the mandatory National Register of Indian Citizens (NRC) exercise, from pushing farm reforms that will turn farmers into corporate slaves to reforming the public distribution system under the “One Nation One Ration Card” scheme to deprive the poor of their right to food, the present dispensation has been incessantly attempting to turn the poor citizens into stateless, rightless and voiceless non-existent beings.

While the poor are being thrown under the bus by the BJP government, the urban elites and middle-class—India’s 20% or around 200m people out of a billion adults who voted for Modi in 2014 and 2019 as well—are enjoying the trickle-down economy’s crumbs. With more privatisation and liquidation of public assets, these hegemonic, upper-caste urban elites and middle-class groups will acquire more wealth vis-à-vis the poorer 50% of India, whose prospects are doomed by the neoliberal economic model.

What’s the way out?

Oxfam’s inequality report suggests a few solutions for India like generating revenue through wealth tax to redistribute the wealth, generation of revenue for social investment in healthcare and education, enactment of statutory social security provisions for informal/unorganised sector workers and reversal of the policies to “shift power in the economy and society”.

As a non-government organisation, these suggestions do fit Oxfam’s philosophy. However, the important question is– can such measures change the scenario for the poor?

The question of wealth tax:

A wealth tax is imposed on the permanent net worth of an individual. People with wealth above a certain level are charged a certain amount of their accounted wealth annually by the government, which will then be used for the upliftment of the underprivileged and marginalised communities.

From the 1950s to 2015, India had its wealth tax that charged 1% of the wealth of a person surpassing Rs 3m per year. In the Union Budget 2015-16, former finance minister Arun Jaitley had it removed. He cited poor collection—Rs 10.08bn in the financial year (FY) 2013-14—of such taxes for the removal.

However, Jaitley had imposed a super-rich surcharge of 2% on the total earning exceeding Rs 10m a year. While the tax slab for those earning over a million a year is 30%, the total surcharge for those earning Rs 10m and above became 12%.

In her Union Budget 2019-20, Union Finance Minister Nirmala Sitharaman hiked the surcharge rates significantly. According to the new rates, one needs to pay a 15% surcharge for an annual income between Rs 10m to Rs 20m, 25% for an income between Rs 20m to Rs 50m and 37% for income above Rs 50m.

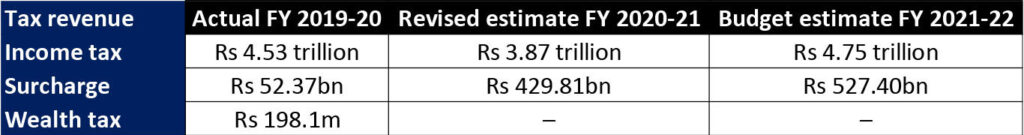

Now this surcharge’s collection has been quite low according to the government’s tax receipt statements. According to the Union Budget 2021-22, the following is the total income tax vs total surcharge collection by the government:

The idea of taxing the super-rich on their income never brings more funds to the government’s coffer as the members of this highest economic strata master in dodging taxes. They do this by taking low paycheques from their companies and diverting their incomes through multiple channels to generate more wealth for them.

Citing the US government’s data, the American non-profit publication ProPublica had shown how the super-rich of the US dodge taxes. According to The Washington Post’s study, the super-rich dodge taxes on more than one-fifth of their income, which is around $175bn a year.

When this parasitic class, the real beneficiaries of monopoly-finance capitalism, can influence the government apparatuses in developed countries like the US and European countries, how can a government in an under-developed India remain immune from them? This is a reason, even if the government imposes a wealth tax on the capitalists, which is highly unlikely, their influence on the ruling party, bureaucracy and other wings will keep them aloof from paying such taxes.

Increasing social spending

Following the World Trade Organization’s (WTO) diktats, the Indian ruling classes have been significantly reducing the spending on social welfare programmes over the years. While the Congress party-led United Progressive Alliance (UPA) regime enacted progressive employment-generation laws like the Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA) to guarantee 100 days of work to the rural population, Modi’s government has been refraining from investing an optimum amount of money in such a programme that also helps in developing rural infrastructure.

Oxfam’s inequality report shows that India is spending far less money on public healthcare and public education vis-à-vis other countries like China, Russia, South Africa, etc. The WTO strictly prescribes that the governments of member countries dissolve public-funded education and healthcare, and hand them over to the market forces so that these essentials of human development can be commodified and profiteered from.

In this article, we have shown how India’s public healthcare has been suffering immensely in the last few years due to the neoliberal economy and why it aggravated the COVID-19 pandemic’s fatality. This article shows how India’s new National Education Policy (NEP 2020) has paved the way for the ouster of poor students from the education system while reserving higher education only for the upper-caste Hindu elites and middle-class.

In its report, Oxfam has shown that due to the discriminative healthcare system, where the rich can afford all facilities and the poor are left to die, the life expectancy of a Dalit woman is 15 years less than an upper-caste woman. In men, Dalit life expectancy is three years lower, tribal life expectancy is four years lower and Muslim life expectancy is one year lower vis-à-vis upper-caste Hindu men.

As the public sector is being liquidated by the Modi regime to enrich Adani and Ambani, the job opportunities that the Dalits, the tribal people and the backward classes (OBCs) had in this sector have ebbed away fast. Now, the only jobs that people from these communities can look forward to are private-sector jobs, where there is no reservation for the marginalised people and where the prejudices and bigotry of the employers decide who will be hired and for how much wages.

In this scenario, expecting that the government will invest more in social welfare programmes, create demand in the rural economy, fund public healthcare and education as well as provide pension and social security to the unorganised sector worker is merely wishful thinking, devoid of pragmatism.

The way out:

It’s not merely the BJP government’s pro-corporate appeasement policies that are widening the wealth gap and worsening India’s economic inequality. Rather, the problem is the existence of the global monopoly-finance capitalism, which rules India through its network of a handful of ultra-rich crony-comprador capitalists and buttresses India’s semi-feudal production relation in the countryside.

The existence of capitalism means more public assets will be liquidated by governments, irrespective of the ruling party, to increase private profits. The existence of capitalism means the widening of the wealth gap and intensification of economic and social inequalities. Moreover, as capitalism has been commodifying everything; essentials from air and water to healthcare and education will be inaccessible to those who can’t afford to pay.

Oxfam’s inequality report only exposed the tip of the iceberg. Until parasitic and moribund monopoly-finance capitalism will continue to thrive unbridled, there can be no cementing of the wealth gap or upliftment of the poor from abject poverty. Only the social ownership of the means of production, the socialisation of major industries and the development of a people-centric economic order can reverse the situation.

An avid reader and a merciless political analyst. When not writing then either reading something, debating something or sipping espresso with a dash of cream. Street photographer. Tweets as @la_muckraker