Recently, the Hindenburg Research organisation conducted an intensive investigation into the Adani Group, an Indian conglomerate involved in energy, infrastructure, mining, agribusiness, and logistics. Due to Hindenburg Research’s report on the Adani Group, the latter lost a combined US $48bn in market capitalisation since January 25th.

A sharp decline was also observed in the Indian market with a blistering drop of 874 pt. The investigation has found proof of stock manipulation and a debt scam connected to Adani’s publicly traded subsidiary, Adani Enterprises Limited (AEL).

It is believed that the company’s stocks were artificially inflated due to a series of internal transactions, comprising the sale of shares by insiders at higher prices and the utilisation of related-party deals to raise revenues.

Now, stock inflation or manipulation is not a new term in the age of stock market euphoria.

Before delving deeper into the current scenario, let’s look at the history of the Adani Group and its involvement in multiple stock fraud incidents. In 2016, a stock fraud incident began to unfold when the Securities and Exchange Board of India (SEBI) launched an investigation into alleged insider trading by several individuals and entities associated with the Adani Group.

The investigation was prompted by a series of suspicious trades in the shares of Adani Enterprises Limited (AEL), the flagship company of the Adani Group, in the days leading up to a major announcement by the company.

According to the SEBI, the individuals and entities involved in the alleged insider trading had used privileged information about the upcoming announcement to purchase large amounts of AEL stock at artificially low prices before the announcement caused the stock prices to spike.

The alleged insider trading resulted in these individuals and entities profiting by millions of rupees. The SEBI’s investigation into the alleged insider trading led to the imposition of penalties on several individuals and entities associated with the Adani Group, including the AEL. However, the investigation also revealed many other questionable business practices by the conglomerate, including the use of shell companies and insider trading by the Adani family members.

The Hindenburg Research’s report on the Adani Group also resonates with the same tune. One major allegation they framed against Adani is that the conglomerate inflated its revenues by booking fake sales from its trading division and overstating the value of its assets. Additionally, the report claims that the company inflated its profits by underreporting its expenses, including the cost of goods sold.

Multiple shell entities have also been found in tax havens like Mauritius, Singapore, etc, which had huge holdings of Adani Group’s shares but no reliable corporate activities.

Here is a list of the important allegations levelled by the Hindenburg Research report on the Adani Group:

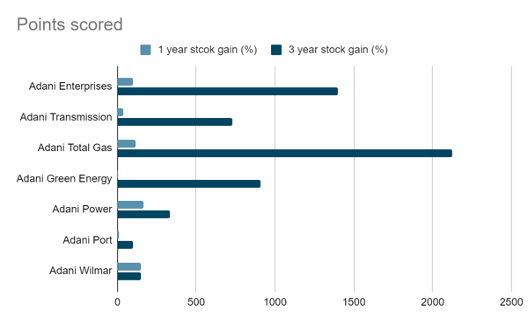

In the last few years, Gautam Adani’s, chairman of the Adani Group, wealth increased by $120 bn, with $100bn coming in the last three years, mostly through meteoric rises in AEL companies’ stock prices. Here is a comparative analysis of the year stock price growth of the AEL:

This euphoria happened due to the over-valuation of Adani Group’s companies for some unknown reason which we will disclose later in the article.

| Company Name | EV/EBITDA | Industry average | Overvalue percentage |

| Adani Green Energy | 101x | 12x | 88.33% |

| Adani Power | 13x | 12x | 10.42% |

| Adani Total Gas | 303x | 9x | 97.16% |

| Adani Transmission | 69x | 12x | 83.01% |

| Adani Enterprises | 66x | 8x | 88.16% |

| Adani Wilmar | 37x | 15x | 58.26% |

| Adani Ports | 20x | 2x | 88.07% |

But creditors are in deep trouble as four registered Adani companies face negative free cash flow, which means that the debt is more than their assets and the other three organisations have some sustainable cash flow structure in their balance books.

These five companies, which have a negative current ratio, have a total debt of Rs 2.33 trillion. In contrast, if we calculate the debt of profitable companies of the group, the figure goes up to Rs 3.01 trillion.

This huge growth in debt happened mostly in the last three years, and public sector banks allegedly helped Adani Group to avail easy credit for their unrealistic expansion plan. CreditSights, a famous credit rating company, substantiated the allegation stating, “several of the Group companies maintain elevated leverage, owing to aggressive expansion plans, that are largely debt-funded and that have pressurized their credit metrics and cash flow (sic)”. Later, the group toned down its criticism of the Adani Group.

As mentioned in the Hindenburg Research’s report on the Adani Group, an anonymous official of India’s central bank, the Reserve Bank of India (RBI), cautioned investors stating, “Any group with such a meteoric ride based on borrowings, acquisitions, and an elevated stock price deserves scrutiny. That said, he [Gautam Adani] also has an amazing ability to buy assets on the cheap. That may mitigate credit risk, but worth examining why.”

Most of the debt is taken against pledging the promoters’ holding. Thus, the recent drop in stock prices triggered a panic in the banking sector as there is no security that the Adani Group can repay most of the money borrowed from the banks.

| Company name | Shares held by promoters (%) | Promoter shares pledged (%) |

| Adani Green Energy | 60.75% | 4.36% |

| Adani Power | 74.97% | 25.01% |

| Adani Total Gas | 74.80% | 0% |

| Adani Transmission | 74.19% | 6.62% |

| Adani Enterprises | 72.63% | 2.66% |

| Adani Ports | 65.13% | 17.31% |

| Ambuja Cements | 63.22% | 0% |

| ACC | 56.69% | 0% |

| Adani Wilmar | 87.94% | 0% |

Now, if we look at the banking structure, the process of giving loans against shares is based on the current market price of the shares and their track record. A recent stock price hike helped Adani get huge loans against their shares. Now the question arises how does this price go up?

Here, we need to understand how the stock price plunge or drop works in the market. Stock price growth or drop simply depends on the supply and demand equation. Stock prices grow when there is a demand for the stock and supply is limited, while stock prices fall when supply is high, but demand is low.

Understanding this simple concept, if we analyse the stock price growth of the listed companies of the Adani Group, it will be clear that the price was artificially inflated using multiple shell entities by increasing the demand and reducing the supply. As per multiple reports published in the daily news portal, multiple suspecting funds are holding a huge stockpile to inflate the price of Adani group shares.

Here is the data from Hindenburg Research’s report on the Adani Group to give readers a glimpse of how suspected funds are inflating the stock prices of the Adani Group.

The data mentioned above clearly shows that the total holdings of the Adani Group are more than 75% of the total share by not complying with the 75% rule of the SEBI.

As per the SEBI’s rules, a listed public company can’t hold more than 75% of their shares, while the biggest four businesses of Adani group are on the verge of delisting due to high holding.

Also, these funds took multiple steps to avoid the threshold of 1% holding to bypass the audit under foreign portfolio investments (FPIs), which makes it mandatory for the listed companies to disclose the names of FPIs with more than 1% equity.

Here is the chart of total FPIs, including small ones (below the 1% threshold) and big ones (above the 1% threshold), in the following Adani Group companies as per its disclosures:

This fraudulent practice of stock price inflation caused a meteoric hike in the stock prices of the AEL.

But we should be clear about the business ethics of the Adani group because fraud is in the DNA of the group. Adani Group is largely controlled by the family members creating opaque and non-transparent financial decisions. In the last 14 years, eight CFOs resigned from their job, showing that the organisation has multiple grey zones in their financial books.

Although it is a family business of the Adani’s, their past is not glorious. Using the family network, the Adani Group allegedly became the principal guilty of corruption, money laundering, theft of taxpayers’ funds and siphoning off an estimated $12m. Per the rule of justice, criminals are punished for committing crimes, while the Adani Group awarded them senior positions in the organisation.

Let’s look at the records of the managing director of Adani Group, Rajesh Adani. It will be found that he was arrested twice in 1999 and 2010 for unscrupulous diamond trading acquisitions. While “the 1999 arrest was over allegations of customs tax evasion, forging import documentation and illegal coal imports, according to one media report”, “The 2010 arrest was linked to a separate allegation of customs tax evasion and undervaluation of imported goods, this time related to naphtha and petroleum products, according to another media report.”

Also, Samir Vora, the brother-in-law of Gautam Adani, was allegedly a kingpin in the same diamond trading scam. Gautam Adani’s elder brother Vinod Adani, the group executive of Adani Group, got involved in multiple diamond and power equipment scams and still takes care of the business in the Middle East.

Now the biggest question arises whether this is something unique done by Adani or is a general trend of all the big corporate houses.

Now let’s take a deep dive into the mechanism of stock market price inflation to understand how this has been going on since the inception of share trading. We still remember how Covid 19 caused huge crashes in the stock market and, in between two months, how the market started reaching new heights.

Back then, the whole manufacturing sector was closed, and common people were on their knees to find stable jobs, which caused a steep decline in demand. But on the other side, the stock market was euphorically growing. But how was it possible? It was possible because of the generous help of the government under the guise of a relief package.

Prime Minister Narendra Modi’s government announced a Rs 20 trillion stimulation package to get the system running. In the same way, the US Federal Reserve and the Central Bank of the European Union also announced such packages to save the common people’s lives. But did the common people receive any aid as claimed by the governments worldwide?

Allegedly, big corporates received the maximum chunk of money as their bail-out money through banks, and they used the fund to buy back their stocks to artificially inflate the pricing by increasing the demand compared to supply. The big funds used this easy money to buy the stocks to increase demand.

Back in covid times, it became evident to market watchers how the share markets were controlled by a handful of companies that constitute less than or equal to 0.1% of the entire society. Utilising the withdrawal of capital controls, or the mobility of capital, the foreign funds rushed to India and entered the speculative trading zone. Large foreign institutional investors (FII) like the Euro-Pacific Growth Fund, Government of Singapore, Oppenheimer, Abu Dhabi Investment Authority, different government pension funds, Global First State Investment, etc, plunged into the market to seize the opportunity to multiply their returns on investment.

Moreover, it’s alleged that Modi’s Bharatiya Janata Party (BJP), which allegedly receives massive support from Mr Adani, not only turned a blind eye towards the unscrupulous practices of the conglomerate but also forced many of the big public sector enterprises like the State Bank of India (SBI), the Life Insurance Corporation (LIC), and others to invest in AEL stocks to buttress the group and inflate its stock prices.

As the stock prices of the group crashed following Hindenburg Research’s report on the Adani Group, the LIC and SBI also suffered immensely. The losses suffered by these public sector enterprises put the common people’s money at risk and eventually can lead India towards a dangerous situation. The small investors and the common people will lose in this massive corporate embezzlement act.

In conclusion, we must accept that this fraudulent practice is universal worldwide. It would be sectarian if we only blame the Adani Group for corruption.

Much before the Hindenburg Research report on the Adani Group’s fraudulent practices came to light, a Reuters report in 2017 claimed that Mukesh Ambani, one of India’s richest billionaires, who owns the conglomerate Reliance Industries Limited (RIL) that has businesses like petrochemicals, telecom, retail, etc, was accused of committing fraud by the SEBI.

It was alleged that before selling a 5% stake in Reliance Petroleum in November 2007, when it was a separately listed company, Ambani “took derivative short positions through third parties in Reliance Petroleum shares, to profit from an ensuing fall in the price following the sale.”

The SEBI banned Mr Ambani’s brother Anil Ambani from the securities market in 2022, and a Rs 700m penalty was imposed on him in 2021. However, despite facing multiple bankruptcy cases, the younger Adani bagged the deal of providing support services to Rafale fighter jets for the Indian Air Force without any prior experience in the domain.

If we look at the global condition, the precedents are the same as India. In late 2022, SBF committed the biggest corporate fraud in the last 40 years, and the US government blessed them with support. The same happened in Europe in 2008, where the Madoff Investment Scandal committed stock and securities fraud.

All this happened because stock market manipulation is always more lucrative and easier than increasing manufacturing and acquiring new markets. After all, rising inequality makes it difficult to raise the rate of profit by selling new products.

Gig working patterns, layoffs and labour rights violations have caused a sharp dip in common people’s real purchasing power, making selling new products in the market difficult. Thus, fraudulent financial practices are common for corporations to increase their rate of profit by manipulating the stock market.

Growing inequality and a dip in purchasing power will increase the number of fraudulent activities in the share market as it is always a preferable and shortcut way for capitalists to quench their thirst for profit. Despite Hindenburg Research’s report on the Adani Group, the scenario will neither change nor the common people and small investors can be saved from greedy sharks in the stock manipulation business.

An avid reader and a leftist. Believes in socialism and a merciless critique of capitalism. Writes columns on politics, economy and society.