The whole world is suffering from the Coronavirus (COVID-19) pandemic and, till the time of writing this report, more than 5.28m people have been infected. To deal with the recent economic crisis, the governments of the developed as well as developing countries came up with several financial stimulus programmes to stabilise the market. Developed countries like the US and European countries have already announced several stimulus packages; India is no exception to it. Prime Minister Narendra Modi, in his 30-minute-long speech, announced a stimulus worth Rs 20 trillion, around 10% of the Indian GDP, which was suggested by the Keynesian economists.

Indian Finance Minister Nirmala Sitharaman has already announced the breakup of the stimulus in five tranches. Like the US and European countries, the Indian government’s so-called “stimulus package” is ready to serve the interests of the capitalist class exclusively. From the beginning of the crisis, the Reserve Bank of India (RBI) announced its desire to buy corporate bonds to stabilise the stock market and reduced the repo rate by a massive 75 basis point to help corporates to take loans at a cheap rate to buy back their shares to increase their prices in the market.

But these attempts were not enough to stabilise the market. By the end of April, it was clear from the day-to-day study of the Indian stock market that it’s way far from stabilisation. Modi in his speech asked India to be self-reliant but the announced stimulus will fail to resolve the crisis as it could not address the real problem.

Even before the pandemic, the Indian market witnessed several shocks in the last few years. The major luxurious goods were suffering from a demand crisis and the COVID-19 only skyrocketed the crisis. The IBBI’s newsletter[PDF] on bankruptcy and insolvency reckoned that there were 115 real estate companies under the corporate insolvency resolution process at the end of September 2019 due to demand crunch.

The real estate crisis has hit non-banking financial companies (NBFC) and put the sector at stake. The IL&FS crisis was enough to understand that whole NBFC sector is perched at the tip of a volcano and it can explode any time. The whole of 2019 suffered from a liquidity crisis for the NBFC sector as the money lent to the sector was not coming back to lend it further.

In August 2019, automobile sales dipped by a record of 23.55%. Major luxurious commodity manufacturers completed their balance sheets with a negative balance. Even the inequality was increasing day by day. A 2019 Oxfam report reckoned that “There are 119 billionaires in India. Their number has increased from only 9 in 2000 to 101 in 2017. Between 2018 and 2022, India is estimated to produce 70 new millionaires every day” but “Many ordinary Indians are not able to access the health care they need. 63 million of them are pushed into poverty because of healthcare costs every year – almost two people every second” and “It would take 941 years for a minimum wage worker in rural India to earn what the top paid executive at a leading Indian garment company earns in a year.” (sic)

So, the present crisis is nothing, but a mere reflection of capitalism’s crisis and the purported COVID-19 stimulus can’t help as it could not address the demand-supply crisis issue. But this stimulus will make the capitalists rich, but the capitalists are not going to invest their extra profits in productive investment; either they will hoard it or put it into speculation to gain more profits or lend it back to the poor through mortgages. So, the household debts will spiral up and a demand crisis will hit the market in no time. Although the so-called “fiscal stimulus” spared a few bucks in the name of the poor as an act of reparation to what they did in their name. So, it is clear that the stimulus is nothing but an adamant approach to rescue the capitalists.

Key points of the “fiscal stimulus” clearly depicted that it’s a mega package for the corporates. Few key points, like the government announced a Rs 3 trillion-worth collateral-free credit to the medium, small and micro enterprises, having a 4-year tenure, and 12 months of a moratorium, Rs 300 billion liquidity facility for NBFCs, housing finance corporations, and micro finance institutions, a Rs 450 billion partial credit guarantee scheme 2.0 for NBFCs, clearly reckon that the whole package is announced to help the production sector, but who will buy it?

The production/manufacturing sector is closed for almost 50 days, most workers do not have a job and lockdown 4.0 won’t allow them to travel to their workplace due to restrictions. So, the Indian economy has entered a vicious cycle of demand-supply crisis.

Due to lockdown 3.0 till mid-May, major sectors have suffered from severe demand crisis as people can’t afford their daily necessary goods because they don’t have any income. Such major sectors like airlines and hotels have already faced a plunge in demand of 70-75%, automobile demand reduced by 50-60%, real estate demand plummeted by 50%.

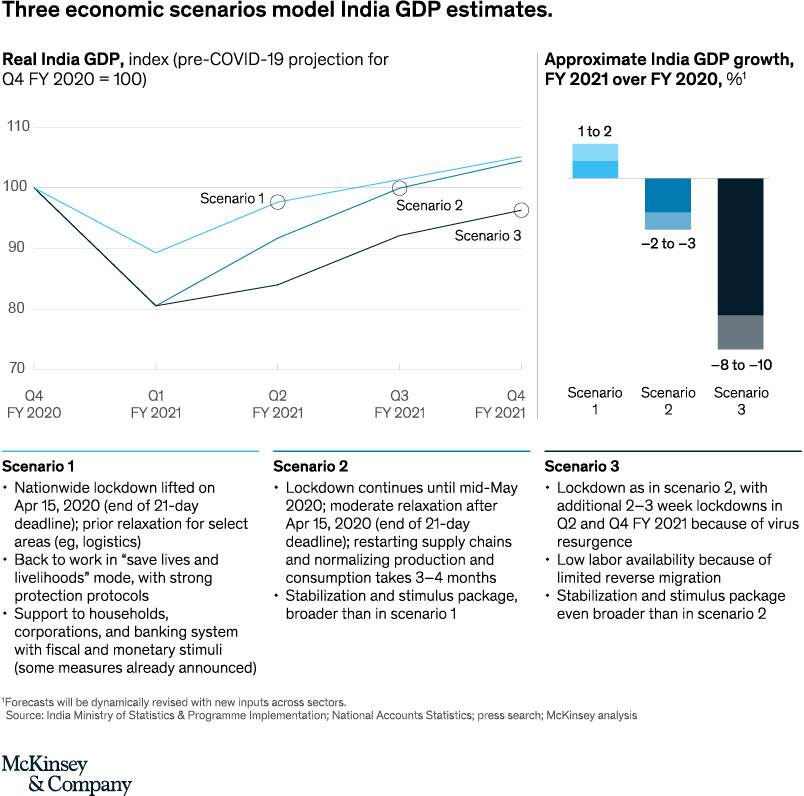

As per a report published by The Economic Times on April 9th 2020, oil demand has slumped by 70% and energy demand suffered a 26% drop from March 18th vis-a-vis the previous ten days due to a complete shut-down in production. A report published by Mckinsey showed that “In scenario 2, the economy could contract sharply by around 20 percent in the first quarter of the fiscal year 2021, with –2 to –3 percent growth for the fiscal year 2021. Here, the lockdown would continue in roughly its current form until mid-May 2020, followed by a very gradual restarting of supply chains. This could put 32 million livelihoods at risk and swell NPLs by seven percentage points. The cost of stabilizing and protecting households, companies, and lenders could exceed 10 lakh crore Indian rupees (exceeding $130 billion), or more than 5 percent of GDP” and if the lockdown is extended by few more weeks the contraction of the economy will increase up to “8-10 percent for fiscal year 2021”.

Due to this economic contraction, a lot of people will lose their jobs. Around 27m youth in India have already lost their job in April and research carried by a group of researchers from Azim Premji University revealed 84% of the self-employed lost their employment and 76% of salaried workers and 81% of casual workers have lost their job as the production shut down for last 50 days and workers have no way to earn money. The job crisis has put the whole country in a severe demand crisis because instead of production the companies have invested more in market speculations. The shift from productive investment to speculative investment will further aggravate the crisis.

Due to the stimulus, optimism reigns in global stock markets, especially in the US. After falling around 30% due to COVID-19 pandemic the US stock market jumped back 30% again in April as the US Federal Reserve pushed a humongous amount of liquidity in the market through buying up bonds and other credit instruments. There is also a hype as it’s believed that the US’s lockdown will be over soon. The same thing happened in India. The economic slowdown was affecting India for the last few years and this COVID-19 recession caused turmoil in the market, but the major Keynesian economists are not ready to accept this recession as a crisis of capitalism. Paul Krugman, an eminent Keynesian economist, reckons this economic crisis as “a natural disaster, like a war, is a temporary event”.

Robert Reich, a leftist economist, described this as a health crisis and not an economic one, and as soon as the health problem is contained the economy would snap back. Nobel laureate Abhijit Vinayak Banerjee and Esther Duflo asked the Indian government to announce financial stimulus to help the poor until the recession resolves. For Keynesian economists, the present crisis is nothing but a seasonal crisis like the one that happened in the tourism industry.

The mainstream economists indulged themselves in a silly argument to characterise whether this crisis is a “demand shock” or a “supply shock”? But they are not ready to accept this as an inevitable capitalist crisis and consider COVID-19 as a mere catalyst. As production had been halted for two months, investment has vanished and trade fell to nadir, the income of the working class, including a section of the white-collar employees, fell considerably. This created a demand crisis, which will continue for a long time and it will further reduce supply as the capitalists will reduce production due to low demand. This is a vicious cycle and will create more unemployment. This is indeed how a capitalist crisis takes place. Though the government thought about stabilising the economy with a “fiscal stimulus” package, which is a credit package for capitalists, it’s never going to work as the capitalists faced a plunge in profitability rate of capital for last few years and any short time survival packages can’t revive this system in long term.

A report carried out by the International Monetary Fund (IMF), authored by Valerie Cerra and Sweta C Saxena, reckoned that the capitalist growth never reaches the old peak after a recession. The graphs are quite helpful to understand the condition of capitalism.

In the same report, the IMF also argued that this does not only happen to a single economy, but it happens to both rich and poor countries. The IMF stated: “Poor countries suffer deeper and more frequent recessions and crises, each time suffering permanent output losses and losing ground (solid lines in chart below).”

The World Health Organization (WHO) has already announced that discovering a COVID-19 vaccine is a distant possibility and there is a good probability of a new wave hitting soon. A new wave of lockdown will cause another slump in the global economy and it will cause a severe economic stagnation as well. If this happens, then all the stimulus, provided already, will go in vain and capitalists will ask for another new set of stimuli for their revival.

It’s not a hollow estimation but the structural reform measures announced by the government, like allowing more foreign direct investment (FDI), dilution of labour laws, coal and mineral mining liberalisation, etc, are a clear indication of government desperation to start the production with all possible anti-people and pro-corporate plans to take the economy back to the old track.

Since a long time, the Modi government has been trying to amend the labour laws and do away with the hard-won rights of the working class. Under the garb of reviving the post-COVID-19 economy, the ruling classes have relaxed the labour laws in major states like Assam, Gujarat, Madhya Pradesh, Punjab, Rajasthan, Telangana, etc. The Modi government has also announced that no case can be lodged against the owners of the company if they do not pay their workers full salary. Even the Supreme Court has spoken in the same tone in a verdict. After tampering labour laws, the Modi government will try to enact the notorious land acquisition act, which was kept in the cold storage since 2015, following a massive nationwide upheaval against it.

Although the Modi government tried its best to regain capitalism’s faith, it failed to do so. The corporates eventually categorised this stimulus as a short-time revival package, but it will not help India to solve the existential crisis. Few can argue that the government’s approach to increasing FDI and coal block auction and other pro-corporate steps will gain the faith of the capitalists shortly. But actually, the capitalists understood that they have no way to resolve this crisis. Even after the announcement of the much-hyped “fiscal stimulus”, foreign investors sold shares worth over a billion dollars in just four days, from May 12th to May 16th.

So, it’s clear that the crisis is not just a mere demand-supply crisis, but the obvious outcome of capitalism and all the stimulus is nothing but a mere temporary approach to jumpstart the economy. The desire to gain more profit by a handful of super-riches is capitalising the probability of collective crisis and the Modi government is helping them with a fiscal stimulus to save the system. Repetitive crisis reckoned that the neoliberal economy is nothing but an over-hyped capitalist system. And it can be asserted that capitalism is nothing but an over-hyped failure story.

An avid reader and a leftist. Believes in socialism and a merciless critique of capitalism. Writes columns on politics, economy and society.